38+ How much can i borrow mortgage compare

So in order to raise the full amount needed to buy the property we need to borrow money through a mortgage. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37.

1

A national survey by Fundable said that 38 of startup businesses relied on money from family or friends.

. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. Please get in touch over the phone or visit us in branch. A standard valuation fee alone can be between 200-500.

How to Borrow from Friends or Family. Rates starting from 399 pa. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

A mortgage is an arrangement where you borrow money from a lender to buy a property whether as a home or investment such as a buy-to-let. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment.

But if you are still shopping for a chattel mortgage you can use. Should you go for a lower. The discharge fee will generally cost between 100-400.

By answering a few questions. Use our chattel mortgage repayment calculator to determine how much you will pay and compare your car loan options below. You can consider a chattel mortgage.

Compare car loans from a range of Australian lenders to find a loan that works for you. The term of a mortgage usually lasts between 25 and 35 years. Its considered a second mortgage since its attached to a home already secured by a first mortgage.

LOW RATE OR CASH BACK. The National Association of Realtor said that 52 of first-time home buyers used money from family mostly parents or friends to buy a house. You can call us on 03 456 100 103 to talk about it or use the calculator below.

Note that your monthly mortgage payments. Working out which ones best for you might seem like hard work but it just means having a good think about your circumstances and cash flow. How much money could you save.

The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. COMPARE TWO VEHICLE LOANS. How much your mortgage will cost every month depends on the type of mortgage you choose.

Homeowners can also deduct mortgage interest expense from their income taxes. Where to get a 300000 mortgage. Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate.

Find out how much you can afford to borrow based on your monthly payment or find out your loan payment based on your purchase price. 15 vs 30 yr. In minutes from the rates decision meeting the Bank said the majority of the MPC felt a more forceful policy action was justified.

The pound has dropped 05 against the euro to 1189. Is an Unusual Option Right for You. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

To get a 300000 home loan youll want to get quotes from at least a few different lendersThough this can be done by reaching out to each mortgage company directly you can also use an online marketplace like Credible. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. A home equity loan is a type of mortgage that allows you to borrow money against your homes equity.

The setup fees for the new loan can cost between 300-1000. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up. The term second mortgage refers to the fact that the second mortgage lender is repaid after the first mortgage lender in a foreclosure.

The lender you apply with takes out. Compare two loans and decide what is right for you. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage.

Monthly payments on a 200000 mortgage. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. How long would you like your mortgage for.

You can do some simple math to estimate how much you might be able to borrow. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. Explore how much you can save by locking in a low rate today.

20- vs 30-Year Mortgage. But if you can compare it against the above chart you can visualize how 15-year loans are much more popular for refinancing than for initial home purchases. It will be difficult to tap some of the sources for.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only.

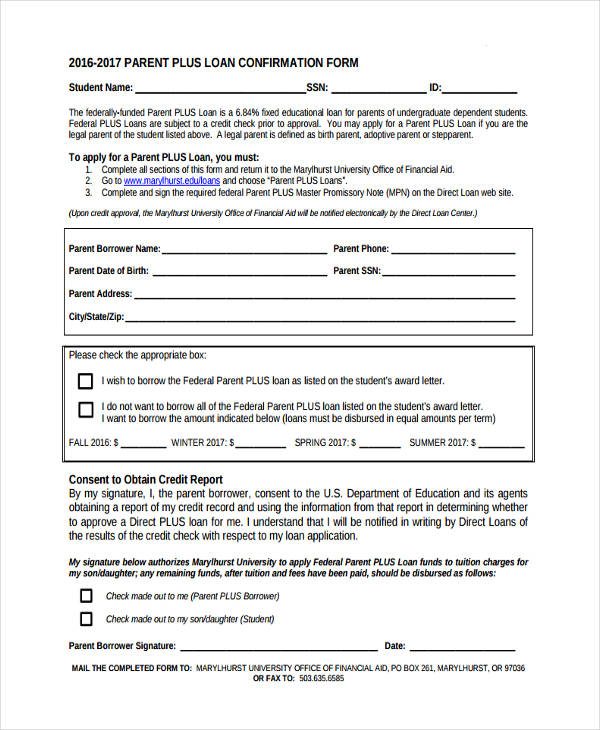

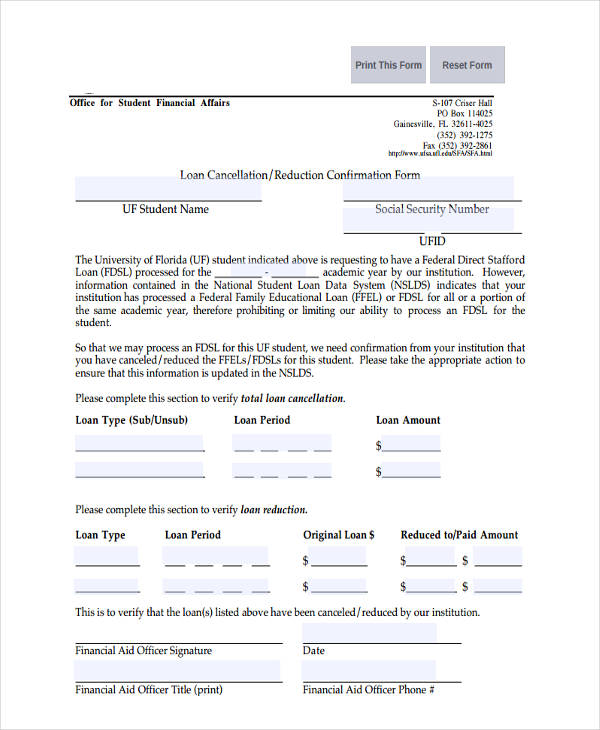

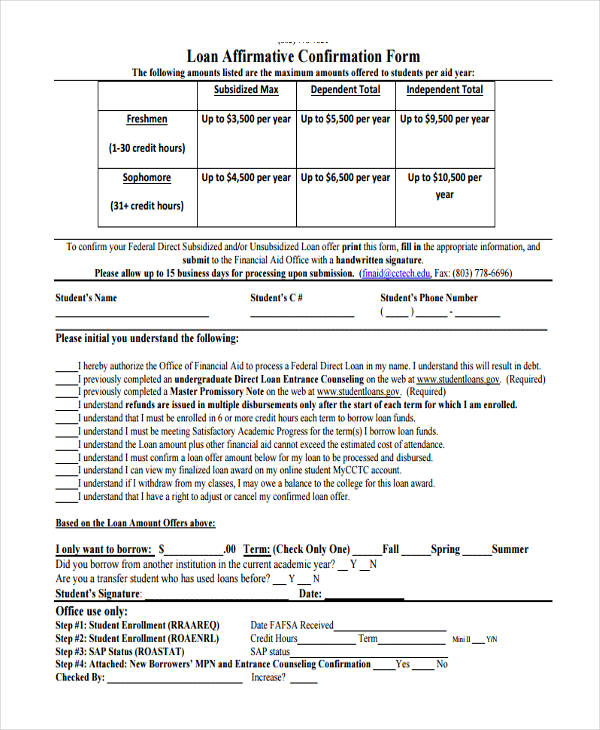

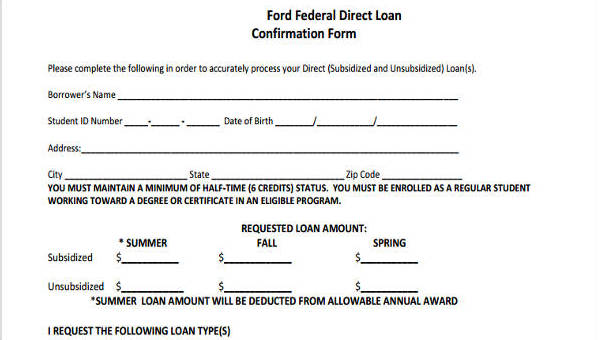

Free 8 Loan Confirmation Forms In Pdf

1

Free 8 Loan Confirmation Forms In Pdf

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 8 Loan Confirmation Forms In Pdf

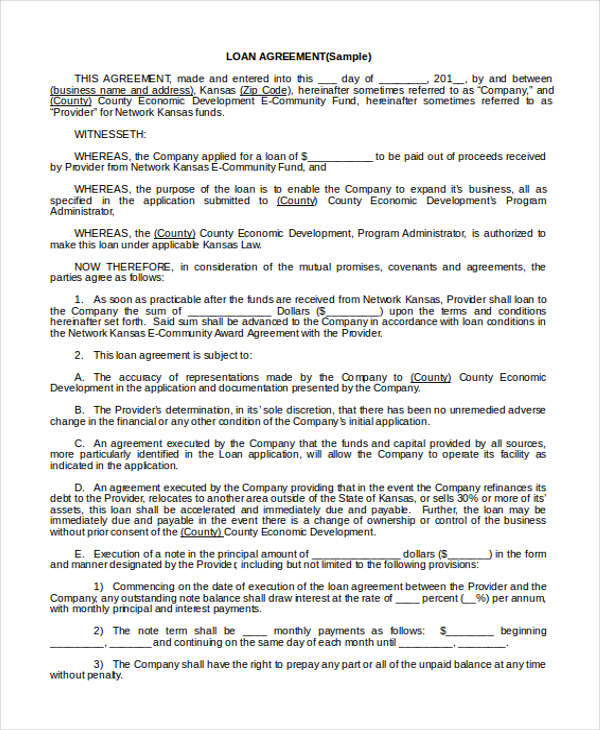

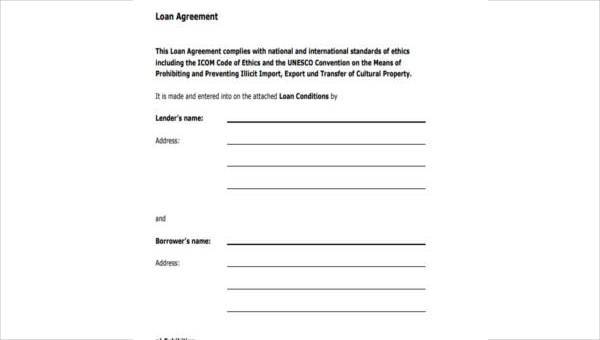

Free 13 Sample Loan Agreement Forms In Pdf Ms Word Excel

Free 34 Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 8 Loan Confirmation Forms In Pdf

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

1

Free 14 Money Promissory Note Samples In Pdf

Lending Money Contract Template Free Luxury Cash Loan Agreement Sample Borrow Money Contract Form Contract Template Agreement Contract

Get Our Free Download Rubric Template For Effective Assessments Check More At Https Moussyusa Com Rubric Template Rubric Template Rubrics Business Template

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 9 Sample Personal Loan Agreement Forms In Pdf Ms Word

1